Collections

Once you’ve linked your bank account, you can start receiving payments by creating a collection. A collection is simply a way to gather payments from your customers.

Creating a Collection

This allows you to set up and configure new collections through a multi-step process. Which consists of three main sections:

- Collection Information

- Payment Setup

- Accounts

Collection Information

The Collection Information section is essential for managing payment collections. It helps you set up important details that are necessary for processing and tracking payments. Here’s what you need to know:

- Collection Name: Give your collection a clear and descriptive name.

- Description: Briefly explain the purpose of the collection.

- Category: Choose a category that best fits your collection type.

- Service Fee (Billing): Here, you select who covers the service fees—either the payer or the biller. Currently, only the payer can be selected.

- Settlement Frequency: Decide how often you want payments to be settled (e.g., daily, weekly, monthly).

By filling out these details, you create a structured framework that makes managing your payment collections easier and more efficient.

Payment Setup

- For the collection amount input field, you specify the total amount for the collection. If you don’t enter a specific amount, it will be determined when generating the invoice.

- The invoice expiration period sets how long invoices are valid, which can be 1 hour, 24 hours, or 48 hours. This expiration period applies to all invoices generated under this collection.

- You can select multiple payment methods that customers can use, including card payments, bank transfers, USSD, and payments at bank branches.

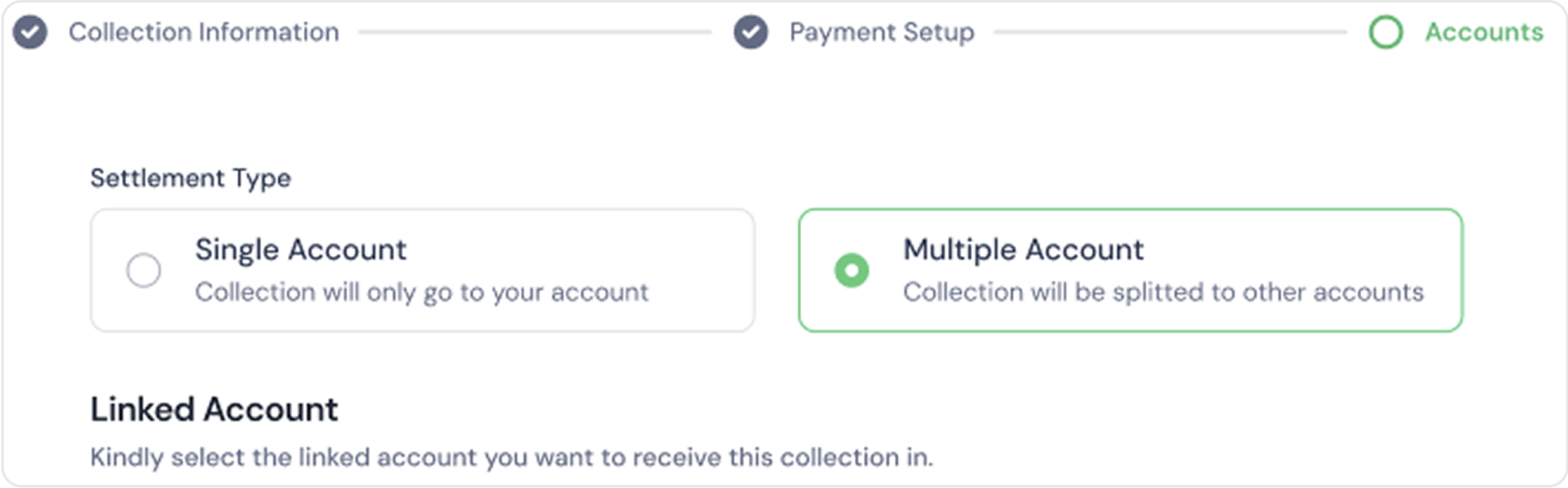

Accounts

Adding a linked account is the final step in creating a collection. This account will receive all settlements for the collection. You can link multiple accounts to distribute funds more efficiently. When multiple accounts are linked, settlements follow a predefined split formula and the settlement frequency chosen during the "Create Collection" step. The split can be based on a percentage or a fixed amount, calculated from the total collection amount. The total split must equal the full collection amount.

Understanding Settlement and Split Formula

- Settlement: The process of transferring collected funds to linked accounts based on the chosen frequency (e.g. daily, weekly, monthly). To more about settlement, click to learn more

- Predefined Split Formula: Defines how funds are shared between accounts:

- Percentage-Based Split - Allocated a set percentage to each account.

- Fixed Amount Split - Assign specific amounts instead of percentages.

For example, if ₦1,000,000 is collected and split by percentage, ₦600,000 (60%) could go to Account A and ₦400,000 (40%) to Account B. With a fixed amount split, you enter exact values instead. By linking accounts and defining a split, settlements are automatically distributed as configured.